A Guide to Navigating Home Insurance Claims in Rhode Island and Massachusetts

Nothing is more worrisome for a homeowner than a damaged roof, especially when the associated cost is unexpected. Extreme weather like hail, high wind, and heavy rain can leave you with questions and concerns, particularly about your insurance coverage.

Below you’ll find some information to help you navigate that process. We can always help walk you through this in person, but here is a breakdown of what you’ll need to know to file a claim, like why getting an assessment from an expert can help you, and how to figure out if filing a claim is right for you.

(TLDR head down to our recommendations at the bottom of this page.)

Check Your Policy.

Our first suggestion is to read through your policy. Under Dwelling or Property Coverage you can typically find coverage for peril or unexpected losses. This is where you’ll find your coverage for events like fire, water, and storms.

Some fire and water damage is avoidable, so that will not be covered in every situation (floods, for example, often require a different policy). Storm damage however isn’t looked at the same way. Hail, rain, and wind are unavoidable, so typically there is a claim to be made.

What Else Do You Need to Know?

Like your credit score, your insurance claims can have an impact on what is available to you. Too many claims can actually result in losing your insurance altogether. Most insurance companies consider two claims in five years to be a threshold. When you have minimal damage, it’s probably best to repair it yourself to not impact larger claims that could arise in the future.

Your deductible is part of this consideration. Most people fix things themselves if the cost to fix is less than or close to their deductible. For instance, if your deductible is $1500 and the cost to repair is $1800, it might be better to take care of the $300 out of pocket versus have the claim on your insurance record and hurt your risk profile with your insurance company. This is a personal decision of course, but something worth considering.

Why Get an Expert Opinion?

You should also think about your roof’s current value. Roof’s depreciate over time and there are two types of coverage for homeowners. One is Actual Cash Value and the other is Replacement Cost Value. Homeowners often go for the Actual Cash Value because it offers lower premiums, but with this option, you’re only paid for the current value of your roof when it’s assessed for the damage. If you need a total roof replacement, this could leave you without coverage.

It’s often best to have a trusted roofing expert help you navigate the process. The first step is have them inspect your roof. Often even an insurance adjuster won’t recognize all the problems or risk factors. Seeking out professional help before you call the insurance company often makes a difference on the amount of coverage you receive.

Is There Anything Else?

If you’re working with storm damage, most insurance companies offer one to two years to file a claim. If you wait too long, it’s automatically denied.

Installation matters. Hiring a trusted professional to install the roof is key. If the insurance company finds that the installation was faulty they won’t cover the roof. This leaves you heading back to the contractor. At Marshall we offer a 15-year warranty on our workmanship. This is uncommon in the industry so make sure you ask about this upfront.

What We Recommend:

1. Call us. We’d be happy to come out and inspect your roof for damage. It’s helpful to have an experienced and licensed contractor to help navigate the process with the insurance company and adjuster. We suggest this as a first step and our inspections are always free.

2. File a claim. Reach out to your insurance company and notify them of the damage. Your insurer may ask you to take pictures and then send out an adjuster. Here is a great link to understanding the different terms and forms for Rhode Island and Massachusetts.

3. After your claim has been filed and approved, the insurance company will provide a “statement of loss” which should be given to your contractor. This document outlines the scope of work covered by your claim.

Once we review the “statement of loss” together, we’ll get to work on your project. Our company has the best warranties in the industry, so you can rest easy knowing that after your roof is installed you’ll be covered in the future for labor and materials.

Overwhelmed? Feel free to give us a call at any time in this process to talk it through 401-438-1499.

We can help, fill out this form to get started.

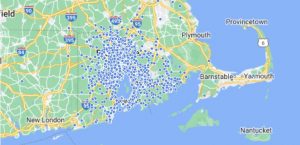

We’ve completed thousands of projects in Rhode Island and Southeastern Massachusetts since 1983.

Get helpful tips in your inbox

Our goal is simply to help you navigate the world of home repairs.